Navigating through COVID-19-challenges in electricity sector

The article was co-authored by Rajnath Ram, Adviser (Energy) at NITI Aayog, Government of India. The views expressed are personal. The article was originally published on CNBC TV18.

- With billions now confined between their physical and virtual walls, the COVID-19 crisis has reaffirmed electricity’s irreplaceable role in modern life.

- The immediate impact of the current lockdown has been the ceasing of commercial and industrial (C&I) load for the whole country.

The ongoing COVID-19 pandemic has highlighted the electricity sector’s importance in maintaining life and livelihood for people in India. Priority has been to keep the lights on in every home and at all essential establishments. With billions now confined between their physical and virtual walls, the crisis has reaffirmed electricity’s irreplaceable role in modern life. Improvements over the past decade in energy access, power quality and capacity addition have ensured that from a high-level perspective, this sector has become much more resilient.

But as every observer of the sector will acknowledge, many challenges have remained, ultimately characterized by financially vulnerable electricity Discoms. How the sector will be impacted in a post-COVID-19 world can only be imagined right now. But few things are certain immediately: constrained growth in electricity demand coupled with weak fossil fuel prices will complicate decarbonization efforts.

Demand glut and Discom finance

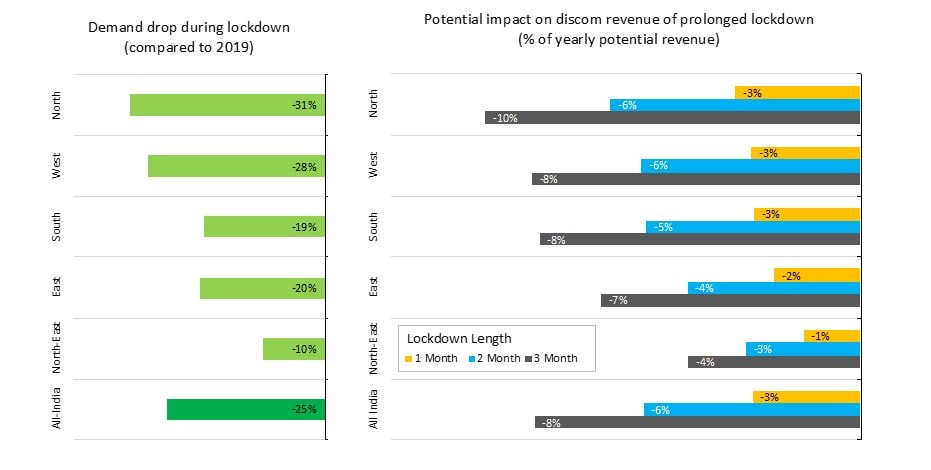

The immediate impact of the current lockdown has been the ceasing of commercial and industrial (C&I) load for the whole country. This has impacted not just overall demand but also Discom finances. A differentiated tariff structure has meant an overreliance on C&I revenue to offset the subsidy given to agricultural and residential customers. With C&I demand mostly absent, the slight increase in residential consumption is inadequate to make up for this drop. A brief initial analysis by RMI India indicates that prolonged lockdown can have negative impact of between 3 percent — 8 percent of the annual revenue.

A riskier electricity distribution sector that will need more government support

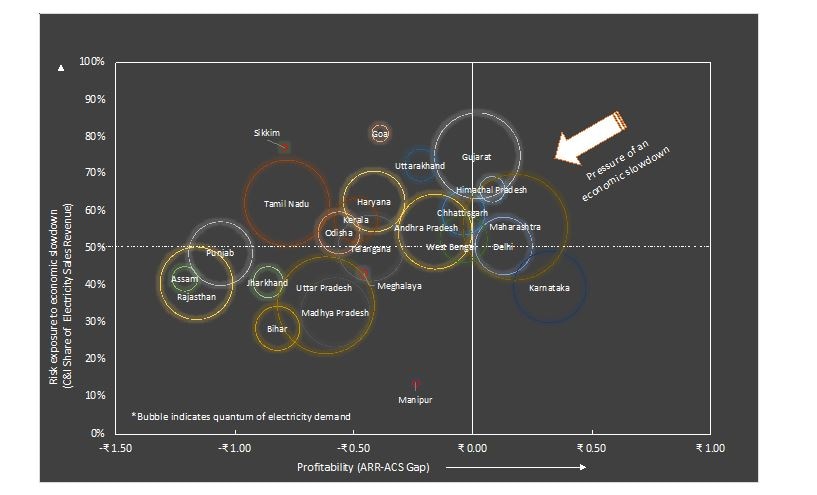

The lockdown is temporary and will eventually ease-out, but the bigger concern is the expected economic slowdown. In its most recent assessment, the IMF expects India’s GDP growth rate to drop by 1.9 percent in 2020-21. Given the dual supply and demand shock that we are dealing with, the economy is likely to take some time to recover to pre-crisis levels of consumption and growth. In the medium term the electricity distribution sector will have to endure a far riskier operational environment (figure 2), especially for states with a higher share of C&I customers and a higher level of cross-subsidy.

Most Discoms operate at either loss or with thin margins with underlying government’s support measures. In the event of low growth, the impetus to sustain the Discoms will fall largely on the government. While being an essential industry, the government may try to keep the sector afloat, it will impact public debt substantially. Various high CAPEX endeavours to modernise the sector, like deployment of smart meters, segregation of feeders etc. are bound to face difficulties. If not handled with a long-term turnaround in mind, the maladies of the Discoms will only multiply with time.

Upstream impact and decarbonization challenges

In view of falling renewable tariff, Discoms are reluctant to honour high-cost PPAs, resulting in negative investor sentiment. Coupled with overcapacity in generation, the prevailing power purchase agreements (PPAs) are being challenged. Existing thermal plants are running at low capacity factors leading to stressed and potentially stranded assets. Increasing ‘must-run’ renewables, and minimal use of power exchanges have been leading to uneconomic dispatch and higher power costs. Discoms are refraining from signing fresh PPA’s. Offtake risks are bound to rise within this climate of depressed demand growth and stressed Discom finance. It will only exacerbate the pains of renewable power developers.

Opportunities at the margin

But these challenges do not have to translate to softening goals on climate change if we recognize the opportunities at the margins.

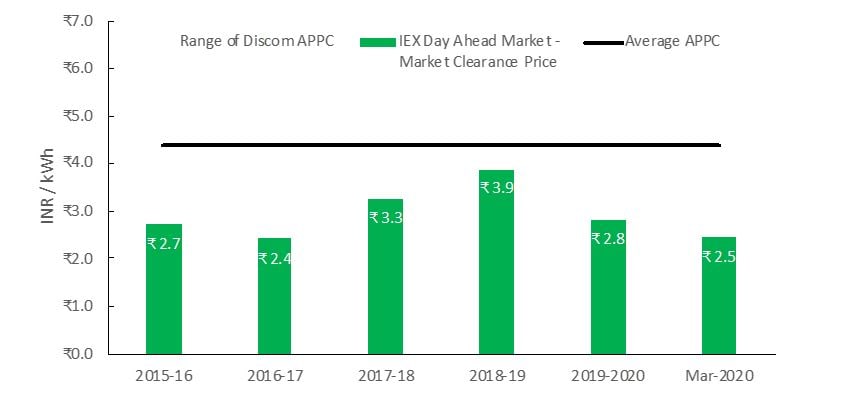

For example, the COVID-19 crisis has highlighted the need for better participation in the wholesale power market. An analysis of the Discoms’ average power purchase cost (APPC) indicate that the price points are consistently above the average market clearance price (MCP) of the day-ahead market at the Indian Energy Exchange (IEX). A rebalance of power procurement between long-term PPA and the wholesale market could provide room to ease the stress of Discom while helping develop a better electricity market through market reforms which can accelerate the deployment of clean energy and better value flexible resources.

Another aspect is the depressed gas prices, both domestic as well as spot LNG. Gas presents a potential area of growth as balancing load for the large renewable fleet in key states where gas connectivity is available. This can help offset the demand for coal while also help in reduced renewable curtailment.

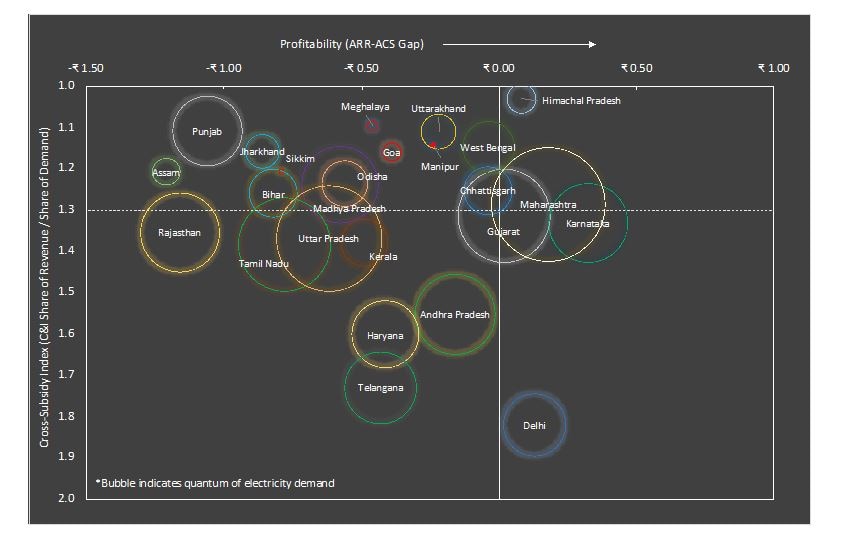

A third potential area that needs to be addressed is tariff reform. The need to encourage economic activity will invariably result in pressure to reduce input costs, including power tariff for C&I customers. Figure 4 looks at Discom’s profitability compared with the level of cross-subsidy quantified as the ratio of C&I share of revenue to the share in energy sales. A lesson from this analysis is that downward pressure on tariff doesn’t necessarily have to come at complete cost to Discom’s profitability.

Rationalizing tariff while reducing Average power procurement cost (APPC) and other operational inefficiencies could lead to more robust growth. The major challenge lies with governments vis-a-vis ensuring affordability to residential and agricultural consumers. It will require strong political will and creative thinking. A redesigned subsidy scheme focusing on direct benefit transfer (DBT) could be one such strategy to achieve welfare goals while being less distortionary to Discom’s financial health.

A crucial medium-term opportunity remains around business process reforms. This can take the form of a revisit of the distribution franchise model (including rural distribution), resilient mini-grid systems independent or semi-independent of the grid, or even rethinking around billing and collection models which could translate to employment generation. A possible model is of a National Electricity Discom (NED) which can takeover state Discoms as a major shareholder by forming SPVs or JVs with them to bring about financial discipline.

The need to think long-term

The urgency of the situation will call for ideation and pilots. The larger ecosystem of experts, think-tanks, consultants and private sector players could be an enabler of such new thinking in this crucial hour. A united voice through a common platform can accelerate the operationalization of many such ideas going forward.

The immediate need for emergency response is inevitable. Priority has been rightly on public health and people’s livelihood. But the recovery story doesn’t have to be pessimistic for the sector. The government has come up with relief measures by providing moratorium on loans up to June 2020, reduction of line of credit to 50 percent as payment security mechanism, and relaxation for completion of energy projects. Over the long term, more smart and patient investment will be needed coupled with requisite sector reforms to enable an increasingly decarbonized, resilient, future-proof and financially viable electricity sector that could be the bedrock of new economic growth.