Impact of Subsidies on Electric Cars in Delhi

The Government of India has been taking various steps to drive the adoption of electric vehicles (EVs) in India for the past few years. However, the sales of electric cars in the country continue to be very low—only around 3,500 a year—as compared to those of conventional internal combustion engine (ICE) cars.

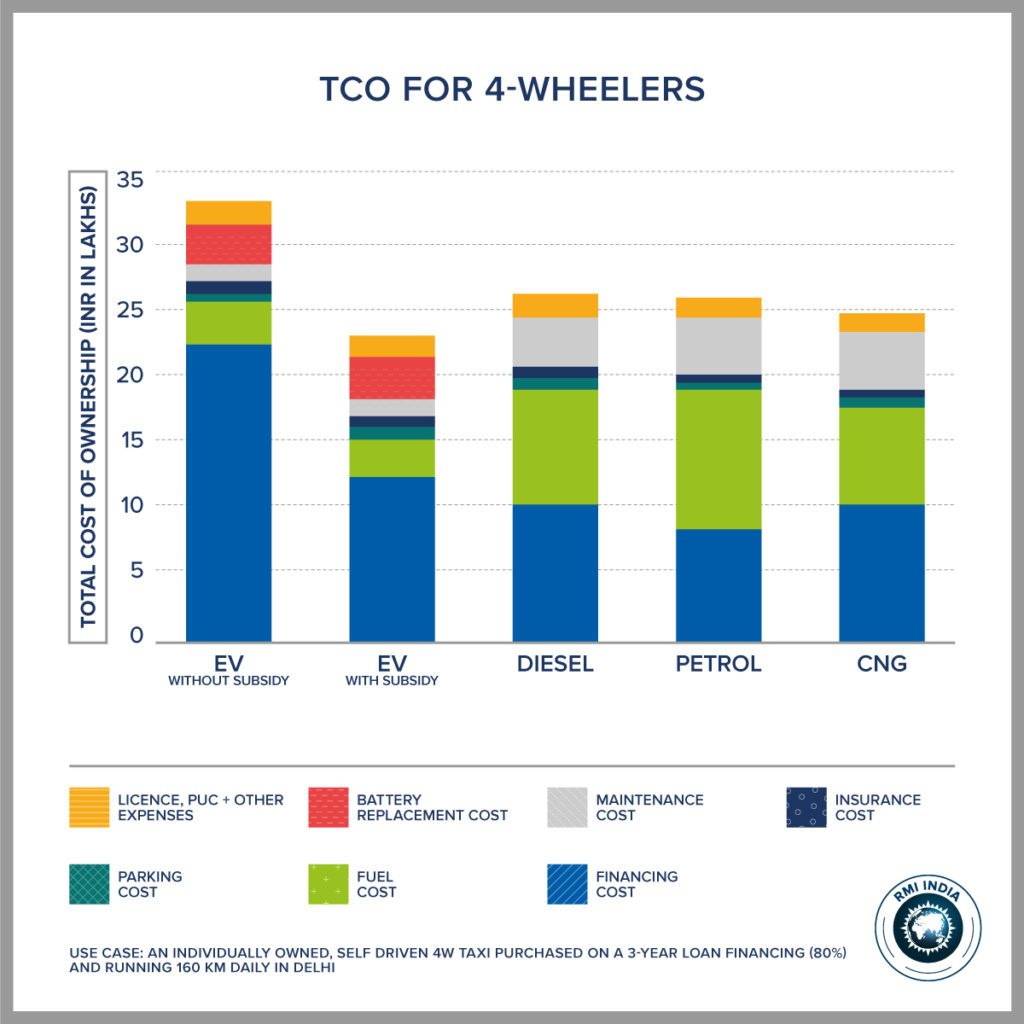

The high initial cost of the electric cars is often cited as one of the key barriers to driving EV adoption. The upfront cost of an electric car purchased for use as a taxi in Delhi is almost double that of a diesel, petrol or compressed natural gas (CNG) car. In order to address this high cost barrier, the Government of India and various states have introduced various schemes and subsidies.

In Delhi, a privately-owned electric taxi can avail of a Good and Service tax (GST) exemption, Faster Adoption and Manufacturing of Electric Vehicles (FAME)-II subsidy, Delhi state government subsidy, income tax benefits, tax collected at source benefit and road tax exemption. These incentives are playing an important role in reducing the total cost of ownership of electric cars and bringing them to cost parity with their ICE counterparts.

Subsides Available for Electric Cars in the Delhi Market

The Government of India has announced a flat GST of 5 percent on ex-showroom cost for any EV as compared to about 29 percent on an ICE car. The Government has also introduced the FAME-II subsidy, which helps reduce the upfront cost of electric cars by around Rs 1.5-2 lakhs.

In addition to these subsidies, the state government of Delhi provides an additional subsidy of Rs 1.5 lakhs on any electric car purchased in the state. The state government has also announced a waiver of road tax for new electric cars registered in Delhi. All these subsidies contribute in reducing the upfront cost of the electric cars purchased in Delhi by about 45 percent.

Government of India also provides income tax benefits up to Rs 1.5 lakhs on the interest paid on loans for electric cars for an individual car owner. Also, the higher cost of the electric car makes the owner eligible to claim refund on the tax collected at source (TCS) in the tax filing for the financial year of purchase.

To assess the effectiveness of all the incentives available to electric cars, it is important to analyse their impact on the total cost of ownership (TCO). This includes the upfront cost of a purchased car plus all other operational costs related to owning and using it throughout the life of the vehicle.

The upfront cost of an electric car is much higher than that of ICE cars, but EVs have lower operational costs. The ‘payback’ period, i.e. the time taken for these lower operational expenses to bridge the upfront cost gap, is one of the many ways of comparing the TCO for electric and ICE cars.

Impact of Incentives on Electric Car TCOs

For the case of an electric taxi operating in Delhi, travelling 160 km daily, payback can be achieved against a diesel car in just 1.9 years, in the presence of subsidies. When compared to a petrol taxi, this payback can be achieved in 2.8 years and for CNG taxi in just 2.6 years. Without incentives, this cost parity is difficult to achieve with current EV market prices.

Similarly, a private car needs to be utilized for at least 75 km daily for a period of 10 years to achieve cost parity with ICE cars when government incentives are provided. Without government incentives, this cost parity cannot be achieved even at daily utilization of 150 km. Thus, incentives play a crucial role in bringing electric cars at cost parity with their ICE counterparts.

Availability of the FAME II subsidy, coupled with higher daily utilization, has primed EVs as an economically efficient choice compared to ICE vehicles for commercial use. On the other hand, for privately owned vehicles which have lower daily utilization and are also not eligible for FAME II incentive, an opportunity to consider an alternate policy framework exists to address the higher upfront cost barrier.

The Path Forward

Incentives play an important role in helping achieve cost parity between EVs and ICE vehicles. The incentives will need to be continued in the near future in order to address the upfront cost barriers and make electric cars attractive to consumers. As EV sales grow and battery technology progresses, economies of scale could drive the EV prices lower to an extent that incentives might no longer be needed. Understanding this interplay between incentives and EV adoption can help further advance India’s transition to electrified transport.

It is also critical to note that along with the costs, EV uptake also depends on the mindset and behaviour of users, as well as operational factors like operating hours or the presence of charging infrastructure. While all these elements will play a crucial role in driving EV adoption in India, achieving cost parity between EVs and conventional ICE vehicles could prove to be the first crucial step towards the end goal.

Download the paper published on Oxford Institute for Energy Studies July journal.