The post What Cities Can Learn from Pune’s EV Readiness Plan appeared first on RMI India.

]]>Transitioning to clean mobility is among the urgent priorities for Indian cities today. Pune has emerged as a leader in facilitating accelerated electric vehicle (EV) adoption. Recently, more than 1 in 10 vehicles registered in Pune is an EV — more than double the national average. Other cities in India and globally can learn a lot from Pune’s actions.

Pune’s EV cell and city EV readiness plan

In 2021, the Pune Municipal Corporation took an ambitious step towards boosting EV adoption by constituting a city EV cell — a centralised, structured governance body for facilitating EV ecosystem-related developments. It is a first-of-its-kind initiative by a local government in the country.

In April 2022, Pune’s EV cell, with technical support from RMI and RMI India, published India’s first City EV Readiness Plan. According to the plan, an EV-ready city creates a favourable ecosystem for seamless mass adoption of EVs by all consumers and users (i.e., residents, institutions, and businesses). Exhibit 1 outlines the core components of an EV-ready city including a defined governance structure; alignment with state EV policy; a robust charging and upstream infrastructure network; an efficient system of sales, financing, after-sales, and end-of-life management; and skill development and awareness programs.

Exhibit 1: Components of an EV-ready city

The Pune City EV Readiness Plan is a set of targets and nearly 10 city-level initiatives that the public and private sectors will undertake to realise the components of an EV-ready city in the near term. To achieve Pune’s targets, the City EV Readiness Plan outlines a set of nine solutions anchored in four focus areas: EV charging and battery swapping infrastructure, easing EV operations, policies and regulations, and awareness programs. These solutions are based on stakeholder consultations and convenings, as well as learnings from national and international best practices. Let’s dive in to five elements of Pune’s EV Readiness Plan.

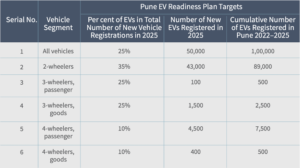

1. City-Specific EV Adoption Targets

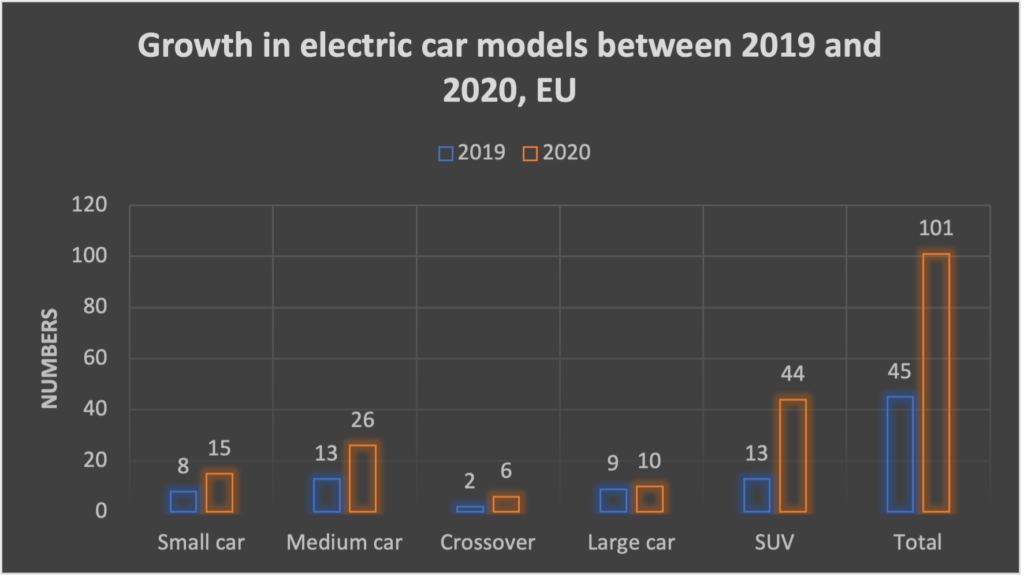

The plan requires preliminary EV adoption targets for 2025 that exceed those outlined in the 2021 Maharashtra EV Policy. City-specific EV adoption targets are crucial as they set ambitious goals, generate commitment and enthusiasm at the local level, and serve as inspiration for the ecosystem. Pune aims for EVs to make up 25 per cent of all new vehicle registrations by 2025 across all vehicle segments. EV penetration for specific vehicle segments range from 35 per cent for two-wheelers to 10 per cent for four-wheelers.

Exhibit 2: Mode-wise electrification targets for Pune

Achieving this target can avoid 1.7 million tonnes of CO2 emissions over the lifetime of the deployed vehicles.

2. EV Charging and Battery-Swapping Infrastructure: A robust charging and battery-swapping infrastructure network is critical for achieving Pune’s ambitious target of 25 per cent of all new registrations to be EVs by 2025. As part of the plan, Pune will formulate a charging infrastructure roadmap along with promoting single window clearance for the deployment of charging and battery-swapping stations. Additionally, Pune aims to map areas that may require upgraded transformers, distribution lines, and other infrastructure, as well as a plan and schedule for making such investments. These actions will ease the charging infrastructure installations, alleviate range anxiety, and provide access to affordable charging and equitable distribution of charging facilities to a large portion of population.

3. Easing EV Operation: At the city level, Pune attempts to ease EV operations through two focused actions: promotion of electric first- and last-mile connectivity and delivery services and creation of low-emission zones (LEZs). Pune EV cell, with support from Pune Regional Transport Office, will encourage fleet aggregators to deploy electric two- and three-wheelers and formalise the commercial registration of these vehicles. Further, aligned to the Maharashtra state EV policy, the plan advocates creation of LEZs where higher-emission vehicles are restricted from entering or are charged a fee to enter, while pedestrians, cyclists, low-emission vehicles, and vehicles meeting other criteria (e.g., shared mobility) are free to . The objective of the LEZ is to improve air quality in Pune by reducing the number of older and less fuel-efficient vehicles that enter the zone. London’s ultra-low emission zone (ULEZ) initiative resulted in 44,100 fewer polluting vehicles entering the ULEZ every day, reducing roadside NO2 pollution by 44 per cent in first 10 months of implementation.

4. Policies and Regulations: Globally, policies and regulations have been crucial in shaping the EV transition. Through the EV readiness plan, Pune aims to strengthen the nascent electric vehicle retrofit ecosystem by offering a low-cost solution to convert internal combustion engine vehicles to EVs. It will also deploy preferential parking regulations to promote EV adoption by providing greater access and affordability to EV users. This can be done through amendments in building bylaws to mandate the provision of EV-ready parking spaces and providing concessional parking rates for EVs in the near future.

5. Awareness Programs: Despite several policies and schemes, potential vehicle buyers have concerns regarding disbursement of fiscal incentives, cost and standards of charging, range anxiety, and much more. These concerns can be addressed through awareness programs along with disseminating information on various national, sub-national and local initiatives. The readiness plan will facilitate the creation of an EV dashboard, which will serve as a one stop destination to provide all the information related to the adoption of electric vehicles in Pune. It will also have a grievance redressal mechanism, that will enable contacting the city EV cell through email for complaint and concerns related to electric mobility. The first version of the EV dashboard was launched in April 2022.

Through its City EV Readiness Plan, Pune has already embarked on building a strong foundation for electric mobility adoption. By offering a framework, solution set, and concrete steps to help make a city EV ready, the city of Pune hopes that India’s first-ever City EV Readiness Plan can serve as inspiration for other cities in India and around the world — and thereby accelerate EV adoption and transport decarbonisation in Pune and beyond.

The post What Cities Can Learn from Pune’s EV Readiness Plan appeared first on RMI India.

]]>The post Transforming Urban Mobility appeared first on RMI India.

]]>Fast forward to 2019. After almost five years away from home studying transport planning in Europe, I noticed a surprising evolution in the city’s mobility system when my close friend and I were reminiscing over a cup of chai at the exact same tapri: a local bus zipped by without a sound or tailpipe emission. “When did Pune get electric buses?” I asked my friend.

That moment piqued my curiosity; I wanted to understand the story behind Pune’s electric buses (e-buses). When I joined RMI India in June 2021, I started supporting our work on decarbonising urban mobility in Pune. Thanks to our partnership with the Pune Municipal Corporation (PMC) and inspired by an e-bus working group at an Urban Mobility Lab workshop co-hosted by the PMC and RMI in October 2018, we received an opportunity to dive deeper into Pune’s e-bus procurement.

Our case study report, Pioneering Electric Buses in Pune: A Case Study of the City’s Initial Procurement and Operations, offers insights and points of reference on the forms of interagency coordination, policy support, business model design, tendering and contracting terms, and infrastructure planning to enable e-bus adoption in Indian cities.

e-Bus Procurement

Pune’s public transport agency, Pune Mahanagar Parivahan Mahamandal Limited (PMPML), joined hands with PMC, Pimpri Chinchwad Municipal Corporation (PCMC), and Pune Smart City Development Corporation Limited (PSCDCL) in 2018 to procure e-buses for the city in a bid to combat local air pollution and promote public transport.

Pune procured e-buses in two phases. First, PMPML issued two tenders in September and December 2018 for 150 e-buses — 25 units of 9-metre air conditioned (AC) e-buses and 125 units of 12-metre AC e-buses. Second, PMPML issued two more tenders for 350 and 150 units of 12-metre AC e-buses in July 2019 and September 2020, respectively. As of March 2022, 220 e-buses are operating in PMPML’s fleet, making it one of the largest e-bus fleets in the country. PMPML also has commissioned three fully operational e-bus depots, including India’s first all-electric bus depot at Bhekrainagar.

Lessons Learned

Pune’s e-bus adoption can teach us many things about electrifying bus fleets, including the importance of political leadership, the economics of electrification, the improved health impacts, and passenger experience.

- Political leadership is critical to adopting transformative urban mobility solutions: Pune is recognised as a leader in urban mobility. The city administration takes a citizen- and environment-centric approach to planning and implementing clean mobility initiatives. For e-buses, senior leaders of the PMC, PCMC, PSCDCL, and PMPML came together to form a working group and were the architects of the city’s commitment to procure e-buses for its public transport fleet. Regular meetings and clear delineation of roles and responsibilities ensured efficient decision-making and coordinated activities.

- The gross cost contract (GCC) model can accelerate e-bus adoption: In PMPML’s procurement, they used the GCC model. Under the GCC model, PMPML pays the operator a per-km fee for a bus service on specific routes. PMPML provided land and depots for charging, parking, and maintenance, as well as requirements for reliable power supply. The operator provides buses, drivers, charging infrastructure, fuelling, and maintenance. By removing the capital cost and operational requirements, the GCC model significantly reduces financial and technological risks.

- Total cost of ownership (TCO) of e-buses can be lower than diesel counterparts: The total cost of ownership (TCO) of a 12-metre, air-conditioned e-bus in Pune without government incentives is estimated at INR56.52/km — about 6 percent lower than a comparable diesel bus at INR59.89/km. With government incentives from PSCDCL and FAME II, TCO is 15 percent lower than diesel and more economical than compressed natural gas (see Exhibit 2).

- Electric buses can have a positive impact on air quality and public health: Electrifying a bus fleet can reduce local air pollution and carbon dioxide (CO2) emissions. According to our analysis, PMPML’s fleet of 650 e-buses could save 1.2 tons of PM5 and 96,000 tons of CO2 compared with an equal-sized fleet of diesel buses over 10 years — equivalent to the lifetime CO2 emissions of nearly 2,000 petrol-fuelled cars.

- Electric buses are popular amongst citizens: E-buses are cleaner and quieter than conventional buses, improving the overall passenger experience. This can help increase public transport ridership and create more demand for electric mobility solutions from residents.

Way forward

Today, as I travel across the city, coming across e-buses operating at full capacity is a common sight. PMPML is on track to meet the target set by the Government of Maharashtra’s EV policy — 25 percent electrification of the public transport bus fleet by 2025 — three years ahead of schedule. The city also plans to procure 300 7-metre mini e-buses for feeder services for the growing metro network in the Pune Metropolitan Region, enhancing access to public transport with an economical, convenient last-mile solution.

Alongside PMPML’s growing e-bus fleet, Pune city has also witnessed a significant rise in electric vehicle (EV) registrations recently. Ten percent of all vehicles registered in March 2022 were electric. I look forward to seeing more EVs on Pune’s roads in the future and continuing to support the city’s transition to a sustainable urban mobility system.

The post Transforming Urban Mobility appeared first on RMI India.

]]>The post Moving towards Gigafactories appeared first on RMI India.

]]>This push towards domestic cell manufacturing is almost half a decade in the making and must be situated within the context of an increasing momentum towards vehicle electrification and grid decarbonization. To aggressively shift towards renewable energy, energy storage, and EVs, the Government announced at COP26 a target of 500 GW of non-fossil fuel energy deployment by 2030. Central and state governments have been signalling strong support for electric vehicles through FAME II, the Auto PLI Scheme, and other supportive policies, including the pledged target of EVs comprising 30% of new vehicle sales by 2030 as part of the EV30@30 campaign of the Clean Energy Ministerial.

Both these pushes are expected to translate to a burgeoning demand for ACC batteries. RMI India and NITI Aayog’s assessment indicates battery demand will rise to between 106 GWh to 260 GWh annually, in the conservative and accelerated demand scenarios. While much of the battery demand is expected to materialize from EVs (up to 40% by 2030), the need for effective renewable integration will accelerate demand growth in the long run. These are in addition to demand for batteries from consumer electronics, which will only grow as the Indian middle class expands and becomes more prosperous. Looking beyond 2030, with the cost of batteries falling, many end-use applications will increasingly become economically viable. This trend will only accelerate as battery performance improves and prices decline.

Beyond decarbonization, domestic battery manufacturing is crucial for energy security. India is dependent on imports for much of its energy value chain — not only commodities like crude oil and natural gas but also products like solar panels and lithium-ion batteries, which are central to decarbonization. As the energy transition accelerates, domestic battery manufacturing will be critical to ensuring a greater degree of energy security for the country. Although batteries will still require raw material imports, a majority share of the value of battery manufacturing can still be captured within the country with the deployment of the right manufacturing, recycling, and supply chain strategies. This also signals an opportunity for research and development investments around niche battery chemistries that could elevate some of the raw material concerns while positioning India for leadership in the next stage of battery innovations.

The momentum for battery manufacturing is not unique to India. Given the global push towards decarbonization, many countries are already moving quickly to establish manufacturing pre-eminence in the battery storage space. China has been the fastest mover, currently responsible for 78% of global battery manufacturing capacity. The United States and Europe follow suit with 8% and 7% of current manufacturing capacity respectively. If India doesn’t act now, it risks losing out on one of the most critical industrial opportunities of the 21st century. It also risks becoming wholly dependent on another set of imports for its energy value chain – one that will also impact the viability of its EV manufacturing industry in the future.

Battery manufacturing thus presents an opportunity to partake and become a leader in a global sunrise industry and accelerate indigenization of the energy and transport value chain. The PLI scheme is a crucial step in competing with the surging investments in battery manufacturing in China, Europe, Southeast Asia, and the United States. It promises to put India in a strong position in the global market and let the country realize the full value from this technology. The strong response of the private sector to the scheme only attests to the urgency of the issue and the opportunity it represents.

The post Moving towards Gigafactories appeared first on RMI India.

]]>The post Reducing Embodied Carbon Is Key to Meeting India’s Climate Targets appeared first on RMI India.

]]>EC Emissions Reduction Targets Are Gaining Global Momentum

The environmental and material challenges associated with EC need nationwide attention, and decarbonizing the built environment across the entire life cycle is critical to meeting the 1.5°C target. In 2019, the buildings sector was responsible for around 38 percent of energy-related CO2 emissions globally and about 24 percent of total energy and process-related CO2 emissions in India. According to the Global Alliance for Buildings and Construction, if the buildings sector aims to be net-zero carbon by 2050, the impact of the decarbonisation actions must be increased by a factor of five across the buildings’ value chain globally.

Fortunately, there is growing ambition from businesses across the built environment value chain, with leading companies announcing net-zero commitments. Manufacturers are launching low-carbon content building materials, not just to protect themselves against the risks of climate change but also to take advantage of the massive opportunities arising as the global economy shifts to net-zero emissions. Dalmia Bharat Cement, Ultra Tech Cement, ACC Cement, Ambuja Cement, JSW steel, Saint-Gobain, and Berger paints are some of the Indian companies with net-zero carbon roadmaps and environmental product declarations for their products.

Why Should We Act Now?

EC emissions have not been addressed at nearly the same scale as operational emissions and energy efficiency improvements in India. Operational carbon emissions can be reduced over time with decarbonising the electricity grid and with energy efficiency retrofits. However, that won’t solve the whole issue if we keep constructing buildings the same way. Carbon-intensive materials and unsustainable construction practices could irreversibly lock in high energy use and inefficiencies for decades to come. Reducing EC emissions from the buildings sector will also significantly improve air quality across the country by reducing air pollution.

In the next 20 years, India’s CO2 emissions are projected to rise by 50 percent, which is the largest for any country. One of the key reasons for this increase is attributed to the buildings sector as India’s total building space is projected to more than double. Estimates suggest that between 40 and 50 percent of resources extracted across the world for materials are used for housing, construction, and infrastructure, and about 20–25 percent of India’s total energy demand comes from the building materials manufacturing industries.

The manufacturing of building materials is both a resource-intensive and an energy-intensive process. India is the second-largest producer of bricks, steel, and cement in the world. Reinforced concrete and steel frames underpin most of the construction in India’s buildings today—around 60 Mt of cement and 14 Mt of steel were consumed for India’s urban construction in 2020. The urbanisation rate in India is expected to rise to 40 percent by 2030–31 and this massive urban transition underpins rapid consumption of energy‐intensive materials such as steel and cement. Here’s a brief snapshot of the projected demand and greenhouse gas emissions associated with these three sectors.

- In the next 30 years, India’s steel demand is estimated to more than quadruple, from around 111 Mt to 489 Mt, and the corresponding CO2 emissions are projected to rise to from around 300 million tons to 837 million tons.

- In the next 20 years, India’s brick demand is projected to multiply by three to four times and reach 750 billion to 1 trillion bricks/year. Brick kilns are responsible for about 66 million tons of CO2 emissions and other harmful carbon monoxide, sulphur dioxide, NOx, and particulate matter emissions across the country.

- India produced 337 million tons of cement in 2019, corresponding to ~250 Mt of CO2 By 2050, that could increase by three to six times. At the same time, the Indian cement industry aims to achieve a 45 percent reduction in emissions intensity by 2050 from its 2010 levels.

Solutions Exist!

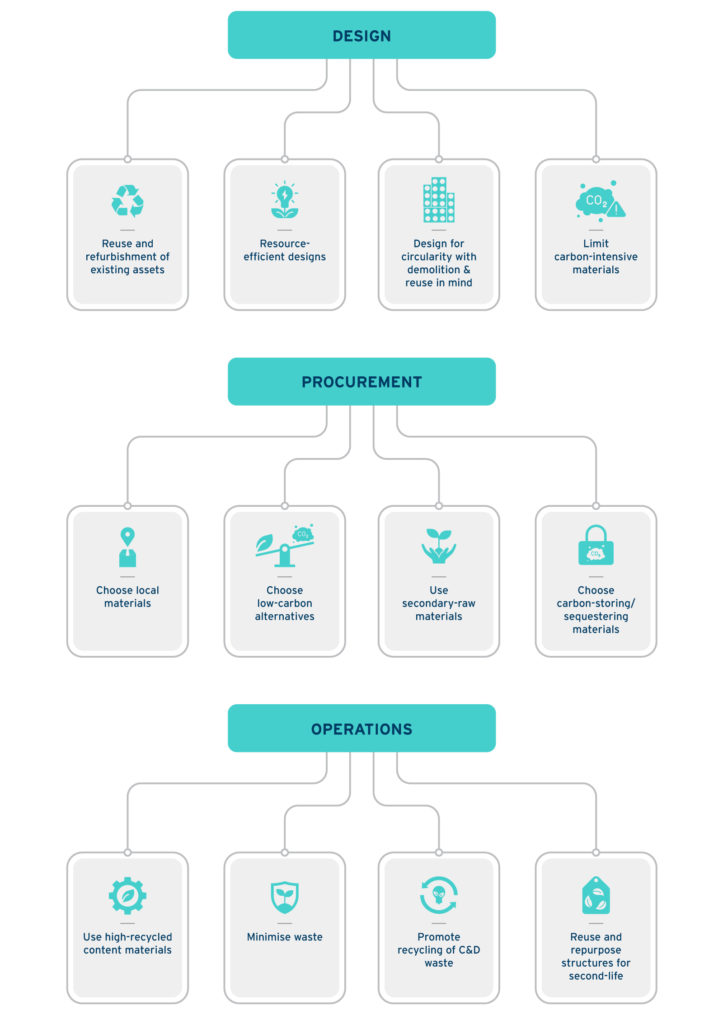

IEA’s estimates suggest that deploying currently available EC solutions could reduce global cumulative CO2 emissions by 70 percent. A broad range of strategies can be adopted at various stages of project execution to reduce material demand and EC emissions in the built environment, as summarised below.

Overarching strategies include the following: 1) Embed EC measurements into buildings ratings systems, codes, and standards; 2) Provide an EC emissions data and accounting platform; and 3) Include EC emissions into corporate ESG commitments.

Overarching strategies include the following: 1) Embed EC measurements into buildings ratings systems, codes, and standards; 2) Provide an EC emissions data and accounting platform; and 3) Include EC emissions into corporate ESG commitments.The Whole Is Greater than the Sum of Its Parts

Fixing any one part of the built environment is not enough to stop climate change. Each of the many different parts need their own solutions. A whole-building life-cycle assessment and a whole systems approach is necessary to understand the EC emissions associated with a project. RMI’s recently released Concrete Solutions Guide provides an overview of proven scalable solutions to reducing embodied carbon in buildings. In a report titled Decarbonizing Heavy Transport and Industrial Heat, Amory Lovins details how steel, aluminium, and cement can be used more sparingly in the buildings sector using new design methods, technologies, materials, and business models. Additionally, with depleting natural resources, increasing the construction and demolition waste recycling rates and recovering valuable materials presents a great emissions reduction potential.

Furthermore, if planned correctly, buildings can be not only less carbon intensive but also carbon negative. Carbon Leadership Forum’s recent study on carbon storing materials shows that a 60 percent reduction in embodied carbon is possible in two to three years by bringing readily available low-carbon materials into wider use across the globe. Green building rating systems and even energy codes could also drive the demand for low-carbon materials. However, for all these solutions to be adopted at sufficient scale and pace, clear pathways have to be developed and implemented, quantified, and specifically aligned with energy and climate goals.

Mainstreaming the Future—The Need for a National-Level Strategy

The resources and affordability crunch, in conjunction with the congestion from urbanisation, provide the perfect opportunity in this climate crisis to develop a national-level strategy to decarbonise the built environment. The Government of India has been implementing several policies and initiatives to promote the use of sustainable building materials, and the net-zero pathways embodied in today’s policies should be realised in full.

Having a national-level narrative and roadmap to net-zero carbon buildings— including embodied energy and carbon—will be central to India’s sustainable economic development. It would create certainty; address any gaps in the supply, demand, and finance aspects; and drive market transformation. Decarbonising the built environment is a profitable business, and if done strategically, can amplify the financial and environmental benefits to India. This is a leapfrog opportunity for India to be a world leader in developing capacities for manufacturing low-carbon materials and compete in the global supply chains. India can show a whole group of energy‐hungry developing economies a decarbonisation pathway where robust economic expansion is fully compatible with emissions reduction.

The post Reducing Embodied Carbon Is Key to Meeting India’s Climate Targets appeared first on RMI India.

]]>The post Greening India’s Home and Vehicle Demand with Low-cost Finance appeared first on RMI India.

]]>Once purchased, assets such as petrol cars and energy-guzzling homes, can be hard for consumers to change, thereby locking in emissions for several decades. Getting it right the first time thus proves especially important.

Lower operational costs for adopters are one of the key advantages of both EVs and NZEBs. However, the upfront cost of both NZEBs and EVs remains a barrier, stalling mass adoption. Price-conscious Indian consumers naturally ask: Who will pay for the gap between conventional and greener alternatives?

Central and state subsidies are already playing a role in bridging the cost premium between vehicles running on petrol/diesel and EVs. Buildings certified under various rating programmes such as the Indian Green Building Council (IGBC) and Green Rating for Integrated Habitat Assessment (GRIHA) are increasingly being allocated incentives by different government entities. In both cases, this government assistance has helped create momentum. However, there exists an oft-overlooked opportunity to reduce the cost premium and improve the attractiveness of both EVs and NZEBs — retail finance.

Retail finance can improve affordability, awareness, and adoption

Retail finance is a key driver of economic growth. Access to credit (in the form of mortgages and loans) has made homes and vehicles more affordable, enabling millions of first-time buyers.

In March 2021, the outstanding housing loans in India amounted to ₹ 22.2 lakh crore ($298 billion) and vehicle loans to ₹ 4.6 lakh crore ($61.7 billion). Retail banking overall forms a fifth of all bank credits (not including the non-banking financial companies or NBFCs). This large market size is indicative of the influence that financial institutions (FIs) can have on transitioning India’s vehicle and housing stock to greener alternatives.

Dedicated ‘green’ loans or mortgages with affordable interest rates and long tenures can help borrowers spread cost premiums across time. Lower operational costs of EVs or NZEBs improve the ability of the borrower to afford equated monthly instalments (EMIs). This reduces the probability of default, creating a win-win scenario for both the FI and the borrower.

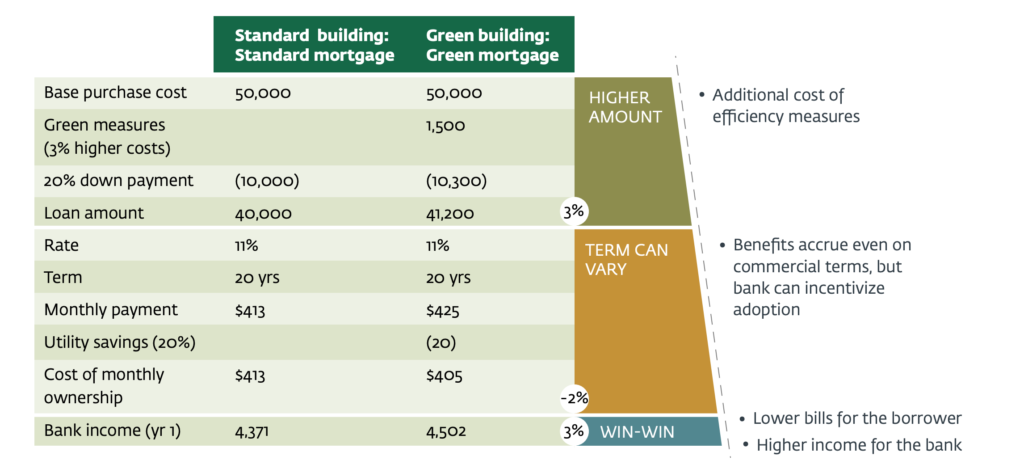

The mortgage example structure in Exhibit 1 shows how a green building can make ownership affordable for the borrower while realising higher incomes for a bank. Longer tenures can be even more advantageous for both.

Exhibit 1: Green mortgage illustrative example for first year (in $). Source: Modified from IFC, 2019

Affordability is only part of the possible impact. FIs also have the potential to enhance consumer awareness. Commercial banks and NBFCs are in regular contact with individuals interested in purchasing new assets. This channel can be instrumental in communicating the financial benefits of EVs or NZEBs and busting myths on ownership. The resulting behavioural change on purchase decisions has the potential of raising the aspirational value and desirability of green assets. Hence, by improving affordability and awareness, FIs can help scale adoption.

Solutions exist but risks need to be overcome

Dedicated green loans and mortgages are not new inventions. In India, too, a few forward-thinking FIs have started developing these products. For example, the State Bank of India has launched a Green Car Loan, whereas the National Housing Bank’s SUNREF India programme is facilitating affordable green housing credit worth ₹ 800 crore ($107 million) in India.

Replicating such products across the retail finance ecosystem requires us to consider current barriers. Unique challenges exist: For EVs, the lack of secondary market is a concern. Meanwhile for NZEBs, developers lack incentives to construct property where operational benefits will pass on to the occupant. However, many risks are common. In both cases, unproven asset value, low awareness of techno-economics, and an uncertain policy environment are seen to be holding back finance.

Moving forward, overcoming these barriers will be important for unlocking the opportunity inherent in greening retail finance. Building the capacity of FIs for developments in EVs and NZEBs will be needed to maximise the potential of dedicated loan or mortgage products. Another common area that needs to be prioritised is data availability on loan performance of EVs and NZEBs. To this end, the Reserve Bank of India (RBI) can designate green assets such as EVs and NZEBs as financial reporting sub-sectors.

Also, the RBI can consider the creation of a sustainable finance taxonomy by setting baselines and definitions for green assets. This will help develop insights into existing green financial products and direct finance to the most effective technologies.

The vehicle and housing finance industries can simultaneously learn from each other. For example, the Government of India’s Partial Risk Sharing Facility for Energy Efficiency is a promising instrument enabling FIs to lend to energy-efficient projects. Risks of financing energy service companies wishing to retrofit buildings are partially covered under this facility, reducing overall transaction costs. Such risk-sharing programmes need to be introduced for EVs as well to improve the lending confidence of FIs.

For EVs, partnerships between FIs and manufacturers help mainstream low-cost financing. Developer-FI partnerships for net-zero energy housing similarly need to be scaled. IIFL Home Finance is an FI already piloting green certification and lending programmes with local developers in Indian cities. Providing technical assistance and data-driven support to the value chain is helping develop a pipeline of NZEBs.

Governments can enable more such partnerships by offering interest rate subventions, stamp duty reductions, and incentives for longer tenures. Creating a shared roadmap for the development of NZEBs will additionally provide direction to the entire ecosystem.

Financial institutions that take the lead, can reap the rewards

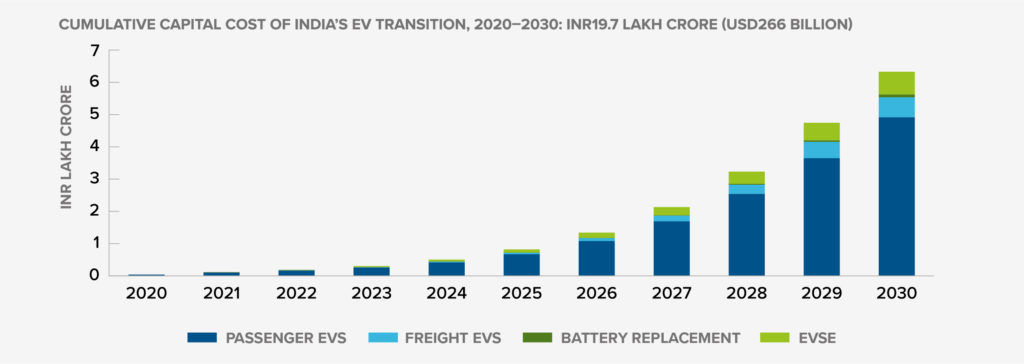

For EVs alone, the cumulative capital investment required by the end of the decade could be as much as ₹ 19.7 lakh crore ($266 billion) (see Exhibit 2). This translates to a loan market of ₹3.7 lakh crore ($50 billion) in 2030. Similarly, estimates suggest a ₹91 lakh crore ($1.25 trillion) investment opportunity in green housing by 2030. FIs that champion green loans and mortgages and proactively enable the market stand to gain the most in these scenarios.

Exhibit 2: Cumulative capital cost of India’s EV transition, 2020-2030, including EVs, batteries, and electric vehicle supply equipment (EVSE). Source: NITI Aayog and RMI, 2021

Energy transition-related risks will also make EVs or NZEBs more worthwhile to lend to in the near-term. Many of the petrol/diesel vehicles that FIs are financing today will start to lose their value as the upfront cost of EVs reduces, emission norms are tightened, and fuel prices increase.

Similarly, as the Energy Conservation Building Code (ECBC) for residential buildings is notified across India and incentive structures are enhanced, the possibility of ‘stranded’ real estate assets may increase. Resilience and energy cost volatility risks should also be considered.

The RBI has already begun to commit to climate action: in April 2021, it joined the Network for Greening the Financial System, a green finance coalition for central banks. This commitment signals the inevitability of green finance in India, of which green lending will be an essential part. Most recently, the Climate Finance Leadership Initiative’s launch in India is demonstrative of the financial potential to accelerate mass consumer adoption of green assets such as EVs and NZEBs, leading the country closer to Paris Agreement goals. With the stage being set, now retail finance must step up.

The post Greening India’s Home and Vehicle Demand with Low-cost Finance appeared first on RMI India.

]]>The post Paving the Path to Efficient Urban Freight Systems appeared first on RMI India.

]]>With this, logistics vehicles’ impacts on urban liveability are becoming more pronounced. Chiefly, urban freight vehicles are significant contributors to air pollution. They emit close to 23,000 tons of particulate matter (PM) emissions every year—17 percent of total freight transport related PM emissions. Goods vehicles were responsible for 10 percent of road fatalities in India’s million-plus cities in 2019. Traffic congestion is also worsened by a lack of management of urban freight.

Urban freight demand is expected to increase by as much as 140 percent in this decade, and this is sure to exacerbate existing negative externalities. Cities have the opportunity to mitigate these negative impacts by overcoming systemic inefficiencies such as poor vehicle loading, uncoordinated deliveries, and improper parking.

Getting to Efficient Freight Systems

Efficient urban freight systems carry the promise of lower emissions, better public health, improved traffic flow, and reduced costs. They can simultaneously support city governments in improving economic development by attracting industries and creating quality jobs.

To guide cities on strategies to improve urban freight efficiency, Ministry of Commerce and Industry recently published a handbook, Enhancing Urban Freight Systems. Co-authored by the Ministry of Commerce and Industry’s Logistics Division, RMI, and RMI India, the handbook outlines best practices that cities can follow to improve freight performance. These are based on globally successful performance improvement measures.

Cities will be able to use the handbook to identify measures to best alleviate the specific challenges they face. And case studies on implementation, internationally as well as in India, can demonstrate the effectiveness of the measures. The fourteen measures presented in the handbook are anchored in three areas: optimising vehicle usage, planning of land use and infrastructure, and promoting smart, clean technologies.

Optimising vehicle usage:

Unplanned and uncoordinated goods movement leads to excessive trips, poor utilisation factors, and vehicles running without loads. Strategically shifting deliveries to off-peak hours to avoid congestion and defining routes for the movement of goods vehicles will save delivery time and cost. Moreover, logistics providers can utilise reverse logistics to reduce trips and empty running.

Strategic planning of land use and infrastructure:

Optimised siting of logistics infrastructure is crucial to managing transportation and inventory costs. Building warehouses, consolidation centres, and logistics hotels and parks at a location that serves the regional and urban freight can improve vehicle use by reducing travel distances and improving load factors. Better land use planning can help separate areas with freight traffic (e.g., industries) from core residential areas. Bypasses for reducing truck movement in cities, parking zones for easy unloading of vehicles, and low emission zones that restrict the entry of internal combustion engine (ICE) goods vehicles can further help reduce pollution and accidents.

Ultimately, this will increase liveability in cities, and city authorities can play a key part in enhancing and integrating different modes of freight transport for long-haul goods movement through multimodal infrastructure such as logistics parks. Similarly, systematic packaging and loading can reduce delivery time and thus enhances productivity.

Promoting smart and clean technologies:

Globally, the logistics sector is undergoing a paradigm shift towards clean and smart technologies. Warehouse operations can be automated to improve efficiency of operations. Supply chains can be digitized using data analytics and artificial intelligence. Furthermore, increasing the adoption of zero-emission vehicles can improve the public health of citizens and enhance energy security.

Coordination and Collaboration Are Needed

Operationalising these strategies will require coordinated efforts by multiple stakeholders in the Indian freight ecosystem. Collaboration across urban policymakers and state authorities; law enforcement agencies; and private players, viz., logistics providers, e-commerce companies, and manufacturers, can enable the effective formulation of policies for cost-effective transport and inventory management.

Recognising the need to focus on city logistics, enhancing efficiency, and reducing costs, Logistics Division recently launched the Freight Smart Cities initiative. Optimisation of vehicle usage, strategic planning of land use and infrastructure, and smart, clean technologies, provide a viable pathway to the creation of Freight Smart Cities.

Several of the fourteen measures highlighted in the handbook are, in fact, quick-win interventions that can be deployed in freight smart cities immediately and can help cities move India towards improved logistics efficiency. Furthermore, rapid deployment of these strategies can help cities enhance their economic competitiveness while delivering on their priority of safer and cleaner urban environments.

The post Paving the Path to Efficient Urban Freight Systems appeared first on RMI India.

]]>The post Incentives, Choices and EMIs – The ICE Recipe for Electric Vehicles appeared first on RMI India.

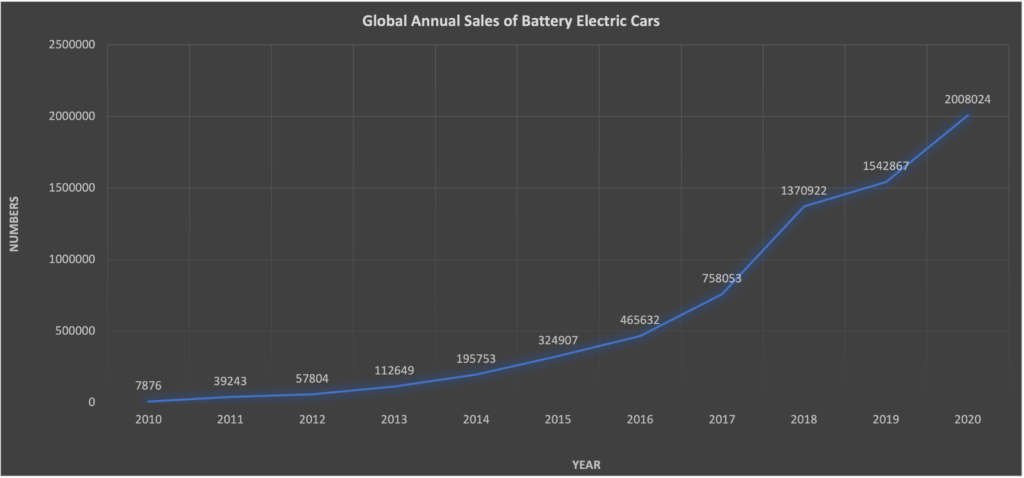

]]>Across the world, merely 8,000 electric cars were sold in 2010 but the decade ended with the sale of about 20 lakh such vehicles. While Norway crossed the threshold of 50 percent share of electric vehicle (EVs) in new sales, the market share of battery-powered cars touched 5 percent in most European nations for the first time.

Source: IEA (2021), Global EV Data Explorer, IEA

Source: IEA (2021), Global EV Data Explorer, IEA

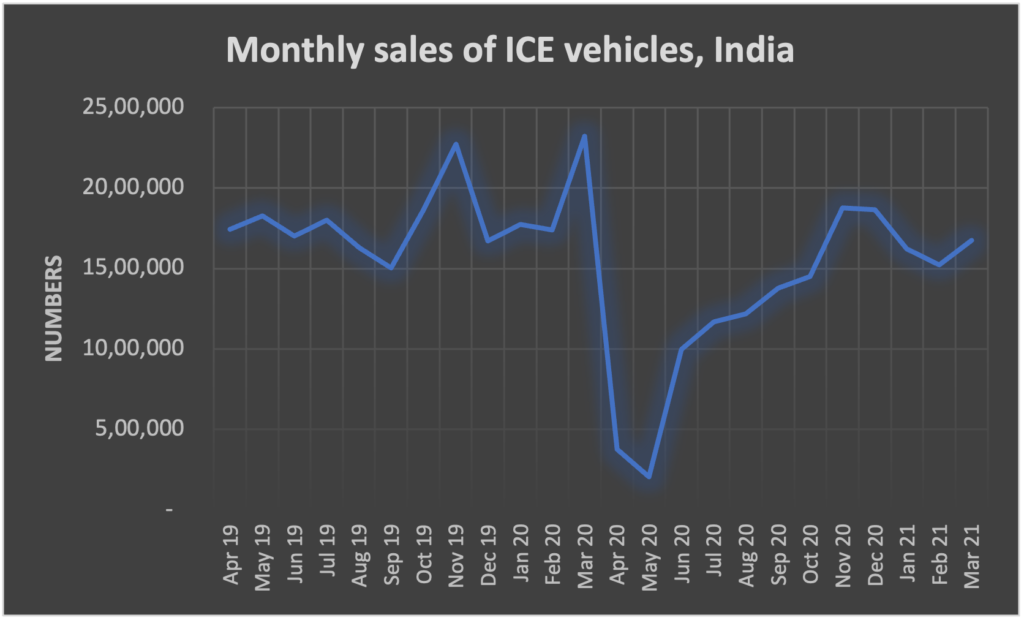

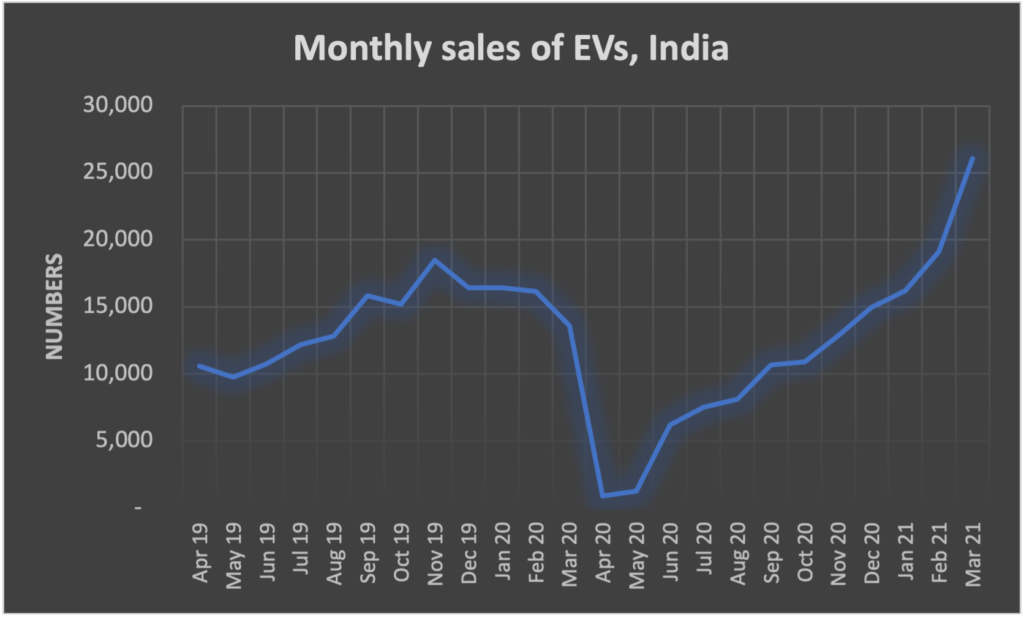

In India, although the base for EVs is low, the monthly sales for internal combustion engine (ICE) vehicles and EVs during pre- and post-COVID first wave showed interesting trends. Unlike their fossil fuel counterparts, EVs were able to exceed ‘pre-first wave’ sales and showed Month-on-Month (MoM) increasing sales till March’21 until the second wave hit the nation. In a few states such as Tamil Nadu and Kerala, EV registrations witnessed 20 to 50 times increase over the last three years.

Source: Vahan Dashboard, Ministry of Road Transport and Highways, Govt. of India

There is an increasing consensus that the leading EV markets globally are very close to reaching the “tipping point” for adoption of electric cars. This trend is considered to have been expedited by (i) innovation and improvement in battery technology and (ii) the falling cost of batteries/electric cars. But are tipping points just a function of technology and price reduction – or is there more to it?

Gerald Kane in his 2019 paper argues that tipping points are not about the technology; they are about people. Tipping points are socially driven, and any attempt to identify a coming inflection has to take the social dimension into account (Gobble, 2019). Countries that are approaching the inflection points for EV adoption indicate that beyond government interventions, which have primarily focused on provision of incentives and infrastructure, three elements are critical to trigger/scale EV adoption. These are:

- Early adopters

- Availability of product choices across all price segments

- Ease of buying in terms of affordable and accessible financing

Early adopters

As typically understood from the new technology diffusion cycle, early adopters are critical for the transition between the first ‘few’ adopters of technology i.e., the ‘innovators’ and the ‘early majority’. The early majority take cues from the feedback of early adopters in their decisions to buy/adopt new technology products.

Source: https://bit.ly/3y2MzDv

It is difficult to predict who the early adopters would be. There is a significant interest from policymakers and industry players to understand this first large EV user group and its characteristics. Studies in a few leading EV markets indicate that their most important distinguishing factors are symbolic motives, willingness to pay and innovativeness – not demographics.

Early adopters should not be confused with the early buyers. They are also unlikely to hold the key to understanding the early majority (Anable et al, 2011). But they are critical because they have the ability to influence the next set of sales by making EVs aspirational.

In the Indian context, the EV sales trends so far have been dominated by affordable and low-speed products in the two and three-wheeled categories. These sales have perhaps been mostly driven more by the need for low-cost/affordable mobility, in a context of lack of public transport and stringent regulations, than the symbolic motive of owning a new/different vehicle technology). For many of these early EV buyers, the primary motivation may be economics, which by itself is not bad, but may not serve as an aspirational beacon for the next set of buyers.

These early EV consumers in India could thus be better classified as early buyers and shouldn’t be confused with or assumed to be the early adopters.

Early adopters are those whose feedback on EVs (rather than a specific EV product) would help the next set of buyers to focus on their ‘aspiration for EVs’ and help their buying decision.

Given their symbolic motivation, a section of early adopters can be expected to purchase EVs that are aspirational. These could be electric sedans/ SUVs or the likes that a large section of consumers will desire to own but may not be able to due to premium pricing. The sales of such aspirational products to early adopters are likely to be low and may not provide the desired scale for India’s EV transition. They will, however, play an important role in boosting the next set of sales (in different and affordable price segments with adequate product choices) that can provide the desired scale.

Choices

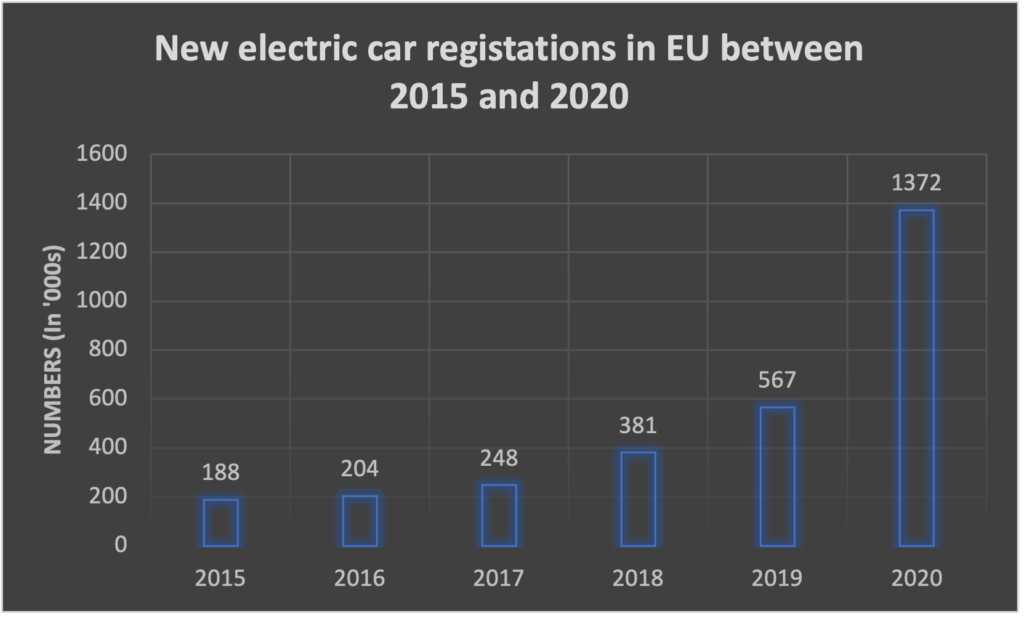

To get the desired mass scale in sales, there needs to be enough EV choices for each consumer/price segment. In European markets, when EV models doubled between 2019 and 2020, more than doubling of sales was observed, as compared to average 30 percent annual growth since 2015.

Source: IEA Global EV Outlook (Various Years)

The incentives and charging points have been in place in these markets for some time and are critical. They have been prerequisites/necessary conditions for EVs to take off but not sufficient for scaled growth. Product choices become equally or more important when the market starts reaching a point where a majority of population is ready to purchase EVs.

In India, the EV product choices range in single digits for segments such as electric cars and were concentrated in similar price bands till recently. About 30-40 years ago, the situation was very similar even for ICE vehicles. The number of models available in the passenger car segment was two in 1982–1983, which rose to eight in 1994–1995, and twenty-eight in 2001–2002 (Miglani, 2019). The sales trends show steep upward trend as product choices increased across all price segments.

If not equal to ICE product choices, it will be important to at least present enough EV choices to Indian consumers. Many would want to transition from ICE and would tend to compare the two technologies and the choices available. The number of product choices and their perceived value – both will become important.

The government has played its part in enabling the initial sales of EVs through incentives and policy reforms. It will now be critical for original equipment manufacturer to step forward and provide the choices and value that the mass sales of EVs would require.

Ease of buying

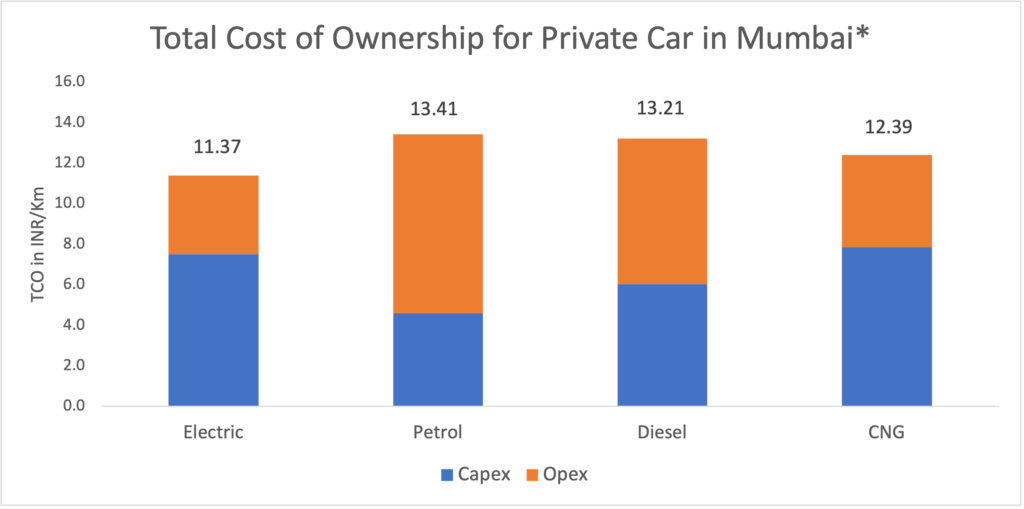

The biggest EV value proposition to consumers will be its operational savings. In the current scenario of exploding petrol and diesel prices, these savings make the differential between ICE and EVs even more significant and the total cost of ownership (TCO) of EVs very attractive. But just an attractive or lower TCO hasn’t been able to draw consumers. The higher upfront cost of EVs or the sticker price shock is still a roadblock for many segments.

While incentives have helped in reducing the upfront price of EVs, the differential with ICE still remains a challenge and will need to be addressed, more desirably by financing than more incentives.

Affordable cost of ownership or ease of buying, hence, will be as important as the TCO of EVs. This would imply addressing the challenge of lack of enough financing options, higher upfront outflow, high interest rates and low loan-to-value ratio. There will be a need for devising financing solutions that increase and ease access to affordable financing.

The ICE recipe for EVs, hence, will require that the current paradigm of an Incentives-based approach now transitions to a Customer-centric approach that aims to enable more EV Choices and Ease of buying through affordable and accessible financing options.

The post Incentives, Choices and EMIs – The ICE Recipe for Electric Vehicles appeared first on RMI India.

]]>The post Electric Vehicles May be the Answer to Rising Fuel Prices appeared first on RMI India.

]]>Over the last two months, India’s second wave of COVID-19 has brought urban areas to a standstill. The public health and socioeconomic impacts of the lockdown have been devastating for families across the country. Now, as we slowly get moving again, household budgets face the challenge of rising transport costs in the form of fuel.

Petrol and diesel prices are at an all-time high. In Mumbai, petrol crossed the ₹ 100 per litre mark on May 29, with diesel not far behind at ₹ 93 per litre. In June last year, petrol was about ₹ 20 per litre cheaper in Mumbai at ₹ 80. In Delhi, petrol prices touched ₹ 95 per litre, as compared to ₹71 per litre last year.

Most parts of the country are witnessing this continuous hike in fuel prices, pushing commuters to look for cheaper mobility solutions. Electric vehicles (EVs) are a potential low-cost alternative that may get traction in the current scenario of rising operational costs of petrol and diesel vehicles. Powered directly by the grid, EVs are increasingly proving to be operationally cheaper for their owners than petrol and diesel vehicles in terms of their total cost of ownership (TCO).

The TCO for any vehicle is the sum of all the costs incurred from owning the vehicle to interest payments, road tax payment, fuel costs, maintenance costs, and finally, the salvage value obtained from selling the vehicle in the second-hand market. The TCO comparison of a vehicle for various fuel types in the current market scenario highlights that the price of owning and operating EV vehicle is lesser than its internal combustion engine (ICE) counterparts. An individual purchasing a private car in Mumbai and travelling an average of 50 km daily, saves ₹ 2 per kilometre effectively by using an electric car over a petrol one. The saving can be as much as ₹ 4.5 per kilometre for a cab driver operating 160 km daily.

*The cost of EV is inclusive of all the incentives available in the market

The higher upfront cost of EVs has historically been a barrier to its adoption. A typical electric car costs almost 40% more than its equivalent petrol car. However, an electric car provides huge savings in its daily operations. In addition to lower fuel cost, lower maintenance and repair costs make it almost a third cheaper than the petrol car. As the prices of petrol and diesel continue to soar and that of EV declines, these savings are expected to continue increasing, making them more and more viable.

Indian EV ecosystem is still in its nascent stage; an enabling environment for its adoption is being created by various actors. The Government of India has introduced subsidies and exemptions exclusively for EVs and an increasing number of state governments are formulating policies designed to accelerate EV adoption. Banks are also recognising the opportunity presented by EVs and creating dedicated low-interest ‘green’ loans to help their customers make the switch. Vehicle batteries which are recognised as the most expensive elements of EVs are steadily becoming cheaper every year.

Altogether, these developments indicate trends of EVs increasingly becoming more affordable than their petrol or diesel equivalents. Choosing an EV over ICE vehicle may no longer be a decision made due to environmental consciousness of consumers: it will also be driven by the fact that EVs will be far easy on the pocket in the longer run. This is sure to be a major win for the price-sensitive Indians, powering the country’s shift to a cleaner mobility future.

The post Electric Vehicles May be the Answer to Rising Fuel Prices appeared first on RMI India.

]]>The post Opportunities for Cleaner, More Efficient Freight Transport in India appeared first on RMI India.

]]>India is one of the fastest-growing economies in the world. Driven by the rising demand for goods and services in India, demand for freight transport is expected to grow fivefold over the next three decades. While the rising freight transport activity will be critical for country’s economic growth and competitiveness, it will also exacerbate challenges related to high logistics costs and high emissions. Logistics costs currently account for 14 percent of India’s gross domestic product (GDP), and the sector accounts for 42 percent of the nation’s overall CO2 emissions from transport. The root causes of these inefficiencies are a heavy reliance on roads to move freight, low operational and vehicle efficiency, and a lack of penetration of cleaner technology alternatives.

The recent Fast Tracking Freight report, coauthored by NITI Aayog and RMI, outlines opportunities for India to reduce the logistics costs to 10 percent of GDP, save 10 gigatons of CO2 emissions between 2020 and 2050, and reduce particulate matter and nitrogen oxide (NOx) emissions by 28 percent and 35 percent respectively over the same time frame.

As shown in the graph below, the report identifies three main opportunities:

- Increase the share of rail transport

- Optimize truck use

- Promote fuel-efficient and zero-emissions vehicle technologies

Opportunity 1: Increase the Share of Rail Transport

Today’s freight system in India relies heavily on road transport: 71 percent of freight moves on roads, while only 19 percent is transported via rail. Rail, a less expensive and less polluting mode of transportation, can be used to move a higher share of freight over long distances through the following solutions:

- Increase the rail network capacity: Rail networks can be upgraded by increasing trains’ load-carrying capacity, increasing train length, and improving the traffic speed and fluidity. New, specialized heavy-haul corridors can be built to move heavy bulk freight on dense networks, while India can keep prioritizing the build-out of Dedicated Freight Corridors (DFCs), which are high-capacity rail networks exclusively for freight.

- Increase the share of intermodal transportation: Intermodal transportation refers to the movement of goods in containers via different modes of transport. Its biggest use case is the movement of non-bulk goods such as consumer goods, electronics, paper, and so on. Intermodal’s share of freight movement can be increased through a well-planned exercise of identifying and upgrading high-potential corridors while ensuring better integration across rail, road, and water modes of transport.

Opportunity 2: Optimize Truck Use

Trucks in India are not used as efficiently as they could be, due to obsolete infrastructure, older vehicles, and the fragmentation of truck ownership. India’s trucking fleets as a whole see low utilization, a high percentage of empty trips, and trucks that are often overloaded. The following solutions can optimize the role of trucks in the Indian freight system:

- Improving transportation practices: Goods transport involves a series of practices like packaging, load matching, vehicle selection, loading, and unloading. Improving these practices across the supply chain can enhance trucking efficiency. Efficient packaging design can help optimize warehouse and truck space. Load matching can reduce delivery times and empty running. Once the load is matched, it is important to select the right type of vehicle for the right use case to optimize the load factors. Finally, standardization and digitization of processes such as pallet matching, implementing data protocols for tracking, and so on, can improve loading and unloading.

- Improving warehousing practices: High-quality warehouses, optimized siting, and digitized processes are crucial for inventory management. These factors are interrelated: digitization can enhance the quality of warehouses and help choose better sites. Better siting, in turn, reduces vehicle kilometers traveled and transit times.

Opportunity 3: Promote Fuel-Efficient and Zero-Emissions Vehicle Technologies

Trucks constitute less than 5 percent of India’s total vehicle fleet but contribute over 34 percent of transport-related CO2 and 53 percent of particulate emissions. The disproportionate emissions result from excessive reliance on diesel fuel, poor fuel economy, a lack of fuel-saving technologies, and a shortage of opportunities to finance those technologies. Solutions to reduce the impact of freight vehicles include:

- Improving the fuel economy of internal combustion engine vehicles: Advancements such as engine and drivetrain improvements, vehicle lightweighting, low rolling resistance tires, and aerodynamic modifications can all improve the fuel economy of freight vehicles. The government can set aggressive fuel consumption and emissions standards to support the uptake of these solutions. Peer-learning industry platforms can be used to share experiences with these technologies to create more confidence among logistics providers and aggregators.

- Promoting the use of ZEVs: ZEVs such as battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) have no tailpipe emissions and offer lower operating costs when compared with internal combustion engine vehicles. Policies such as upfront purchase incentives, ZEV mandates, vehicle scrappage schemes, and zero-emissions vehicle zones can spur both the demand and supply of ZEVs. Additionally, multistakeholder pilot projects can support policy implementation.

Moving Freight Forward

Concrete efforts from the government and industry players in a phased manner can unlock the opportunities and provide a path to implement the measures discussed above. The first phase should tap into solutions that are already economically feasible, such as rail network upgrades, bans on overloaded trucks, and state-level policies for freight electrification. The second phase should scale those solutions and focus on public-private collaboration for policy and infrastructure interventions to standardize and enable interoperability between transport modes and assets.

By Phase 3, India can aim to move 40 percent of freight demand to rail transport, shift all new freight vehicles sold to electric vehicles, and have best-in-class logistics practices. Efficient, cost-effective, and clean freight movement can elevate India’s logistics and export competitiveness across the world. It can also bolster domestic manufacturing and economic development, improve air quality, and mitigate the rise of greenhouse gas emissions—helping lead the way to a clean, efficient, and prosperous future.

The post Opportunities for Cleaner, More Efficient Freight Transport in India appeared first on RMI India.

]]>The post Weathering Climate Risks appeared first on RMI India.

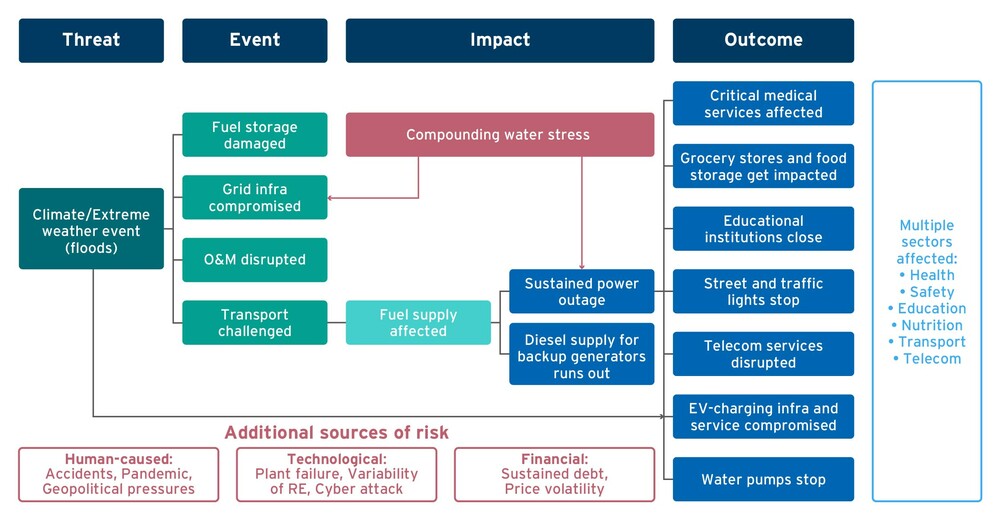

]]>With electrification being front and center of the global energy transition, the power sector has become central to climate action. Increasing electrification means that the power sector will progressively support newer sectors such as transportation and cooking, in addition to critical services such as health, education, telecom, financial services, and more. The vulnerability of the grid to climate change and extreme weather events will no longer be confined to the electricity value chain. It is bound to be compounded across the whole economy, potentially imposing high social and economic costs.

This vulnerability also extends to the pace of renewable energy adoption. Extreme weather events do not just increase the cost of heavy physical infrastructure (for both fossil fuel and renewable-based systems), but also negatively impact generation and operational efficiency. For example, in India, the need for climate resilience of the power sector is heightened because of factors such as rising heat and water stress as well as extreme weather events like cyclones and floods. Such external disruptions pose both physical and operational risks and increase electricity demand along with increasing dependence on the electricity grid.

The associated uncertainty of climate risks also makes accurate renewable forecasting difficult, posing challenges to grid integration of variable renewable energy sources. As such, mainstreaming climate resilience in our energy transition and electricity infrastructure planning must take center stage in the coming decade.

It is important to note that resilience thinking acknowledges both structural (physical electricity infrastructure) and non-structural (policy, regulation, data, technology, communication, management, etc.) aspects of the sector. Therefore, building resilience against climate risks requires upgrades across power sector-associated governance, management, technology, infrastructure, and finance paradigms.

Key Strategies of Resilience Planning

Redefining Infrastructure and Equipment Standards

Before a disruptive event, the overarching governance, regulatory, and procurement processes should be readied by redefining infrastructure and equipment standards and specifications. This includes leveraging the existing disaster management framework for the power sector and implementing newer, customized plans and frameworks that look beyond legacy climate risks.

Taking a Bottom-Up Approach

At the same time, given the benefits of decentralized energy resources (DERs) in extending access and reliability of supply to towns and villages, a bottom-up approach in power sector planning can help acquire lessons from local contexts, risks, and response strategies. Training locals to operate, maintain, and repair infrastructure may work to reduce lead times in responding to and recovering from any disruption.

Adapting Market Design

On the other hand, the market design needs to adapt to the changing risk scenario as well. The recent draft National Electricity Policy 2021 released by the Ministry of Power supports the promotion of renewable-powered minigrids, islanding of systems into microgrids, and using hydro and hydrogen storage to balance electricity load. It also calls for distribution service aggregators. The Central Electricity Regulatory Commission has drafted ancillary services market regulations that allow energy storage and demand response to participate in the market. These are welcome signs from the point of view of system flexibility and reliability—making DERs more viable and contributing to resilience building.

Using Granular and Accessible Climate Data

However, effective governance and management requires granular and accessible climate data in a format that is digestible by power sector planners and utilities. On the end-use side, access to relevant electricity data can enable users to respond to disruptions by changing use patterns. It follows from this that to make the electricity system more nimble, the entire value chain could use a technological and infrastructural upgrade.

Using Advanced Technologies

Technologies enabled by digitalization such as asset management tools and digital twinning, along with introducing redundancy and islanding capabilities in the system, can help prevent systemwide disruptions. For example, India has the largest operating synchronous grid in the world. And while this offers flexibility, it is also at risk from systemwide failures. The linearity of the power system further enables disruptions to cascade down the value chain. At the same time, two or more disruptions can coincide and affect different components of the electricity ecosystem.

The transmission and distribution (T&D) system specifically can prevent cascading disruptions through adoption of DERs and innovation in battery storage. Non-wire alternatives like virtual power lines can take advantage of utility-scale batteries at the generation and demand end to manage load on congested T&D networks. These can also offer ancillary services and help facilitate variable renewable energy integration onto the grid. Other measures such as use of advanced renewable energy forecasting and advanced metering infrastructure can enable distribution companies to cut costs and identify areas of disruptions to provide swift response.

Enacting Resilience Pricing

Finally, pricing resilience needs to assume importance to give cash-strapped utilities an indication of both the necessary costs to undertake resilience building measures, and the potential savings, or costs avoided, due to these interventions. The familiarization of the financial sector to long-term climate risks can help in the provision of appropriate financial instruments for the power sector and introduce climate risk screening in authorizing funds for developers. Other market-based instruments such as bonds, insurance, and international climate and energy finance can also be explored for financing.

Resilience thinking enables a proactive, forward-looking, and iterative approach to planning. The whole stakeholder ecosystem of the power sector must come together to understand the nuances of the unprecedented challenges that climate risks pose to the sector. Most importantly, resilience thinking must be integrated into established structures and methods if India is to truly achieve its clean energy and development ambitions.

Download Powering Through: A Climate Resilient Future: Recommendations for the Indian Power Sector

The post Weathering Climate Risks appeared first on RMI India.

]]>